SUMMER CROPS IN EUROPE – Despite good forecasts the market remains tight

The least we can say is that the winter crops have been particularly disappointing this year.

It must be said that between June and August, Europe will have experienced many extreme weather and climate events, as highlighted by the European Commission in its latest JRC MARS BULLETIN of 20 September.

Last summer was among the three hottest since 1979 in several parts of Europe and was also particularly dry.

In mid-July, severe flooding also affected Germany, Belgium, the Netherlands and Switzerland.

So what is the balance sheet for the winter crops?

In France,

a spring too dry and particularly wet conditions between mid-June and mid-August will have delayed the harvest by about 15 days, in many regions.

Germination problems have impacted many species.

The quality of organic soft wheats is quite heterogeneous and, like conventional wheats, presents SW a little low but very satisfactory protein levels and Hagberg finally rather correct.

Some batches have been downgraded to feed use but no concern in view of the area sown, yields per hectare and carry-over stocks.

The harvest of organic rapeseed has also been very heterogeneous.

Surfaces have been destroyed in some areas as a result of frost episodes, and the lack of water has led to very poor yields.

Among those which have suffered the most, we find lentils, green peas, chickpeas, flax seeds and many other species …

Surfaces turned over because of a too dry spring, germinated seeds because of a too rainy summer and et the end catastrophic yields!

This is particularly the case of green lentils of which it is announced a great shortage in 2021 crop, as moreover in crop 2022, due to lack of seeds.

In Italy,

the summer was marked by high temperatures and drought.

The wheat was harvested in normal times or slightly late.

Yields and quality of organic soft wheat have been very satisfactory in the north of the country.

The harvests of green peas and chickpeas are rather disappointing, as is the durum wheat harvest in the large production basins of the center and south.

It is true that these areas have suffered from the lack of water but also from local rainy episodes that have been too intense.

However, the crescendo increase in organic durum wheat prices – +100/150 EUR/T compared to the beginning of the 2020 season with prices currently at 550 EUR/T to the farmer – is due in particular to the pressure caused by the poor European harvest, and especially Canadian, as well as the ever-increasing demand from major Italian semolina makers, present in the organic sector for several years now.

It is a safe bet that the 2021/2022 season of conventional and organic durum wheat will therefore be very complicated…

In Spain,

the harvest of winter cereals did not show a significant delay in the south of the country, on the other hand, in the center and in the north, it dragged a little long.

The yields and qualities of soft and hard wheats have been very correct which does not prevent organic prices from being firm in the wake of conventional.

Spain seems to be, in fact, one of the European countries that has fared best, therefore stirring up external demand.

Small downside, however, protein crop yields have not been optimal.

The rest of Europe has generally suffered from an excessively rainy summer which has delayed harvests by a fortnight and often caused qualitative problems such as germination.

In this context, the prices of European organic winter and spring cereals are rising and a shortage on many species already seems to be looming.

What are the forecasts for the summer crops?

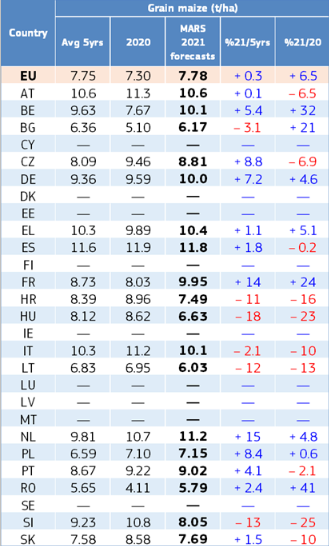

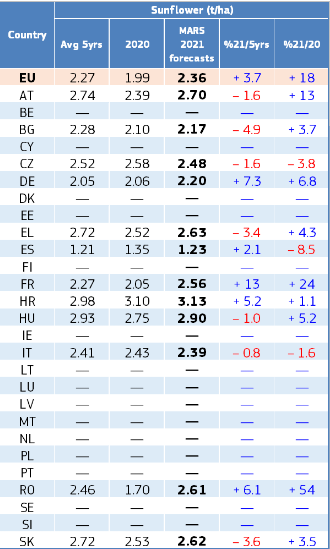

The rainfall that fell on the Iberian Peninsula at the end of June and during July as well as the cooler temperatures for the season, were beneficial to the maize and sunflower crops.

In return, the sunflower harvest started later, the time for the latter to complete their maturity.

The month of August, with its heat wave in the middle of the month, helped a lot.

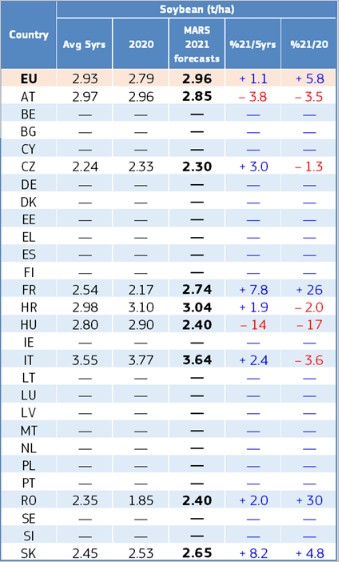

Yields, according to the latest JRC MARS BULLETIN, are announced in the average of the last 5 years, but at -8.5% compared to 2020 which maintains the pressure on prices.

As for soybeans, its production remains in Spain very anecdotal.

In the Italian peninsula, yield forecasts are announced below the five-year average.

The summer was very hot and very dry in many areas.

Compared to 2021, the forecast is -1.6% in sunflower, -10% in corn and -3.6% in soybeans.

Rainfall in late August was too late to compensate for the long period of drought.

Stormy and hail episodes have even caused local damage to crops : at the end of August in Veneto and Emilia-Romagna, and mid-September, in Piedmont and Lombardy.

In French hexagon, the sowings of corn, sunflower and soybeans will have been late because of a dry and cold spring.

If the conditions of implantation have not been ideal, on the other hand, the summer rainfall coupled with the heat will have been beneficial.

The summer was still cooler and wetter in the majority of large production basins, so harvests are delayed.

Be careful that the rains do not hinder the harvest work too much and do not cause diseases.

The yield forecasts of the MARCH BULLETIN Vol 29 give, compared to 2020, +24% in sunflower, +24% in corn and +26% in soybeans.

Other European countries are also expected to experience very good returns this year.

This is the case in Romania, where we expect +54% in sunflower, +41% in corn and +30% in soybeans after particularly bad 2020 yields.

Source : JRC MARS Bulletin Vol. 29 No 9 – 20 September 2021 https://ec.europa.eu/jrc/sites/default/files/jrc-mars-bulletin-vol29-no9.pdf

While the outlook for the autumn harvest is good, organic prices continue to climb.

While the oleic sunflower oil market is still heavy with prices at its lowest, the demand for oil expellers is prompting seed sellers to maintain firm prices.

Oilers, on the other hand, try to compensate for low oil levels with high oilcake offers.

But all this is nothing compared to soy for which a real auction is practiced!

The needs of feedstuff industries for soybean meal will be such from January 2022 and the modification of the European organic regulation, that there seems to be no longer any limit to the increase.

Especially since supplies from third countries still seem as complex as ever and their competitiveness is clearly undermined by additional costs related to freight that do not yet seem ready to settle. Is the surge in containers freight prices over?

A real battle is therefore open to recover the maximum amount of soybeans for livestock feed.

But is the FOOD sector aware of what is happening behind its back and how will it react?

Will he be willing to pay the price?

And how far will feedstuff companies be willing to go?

In this climb, many risk losing their feathers…