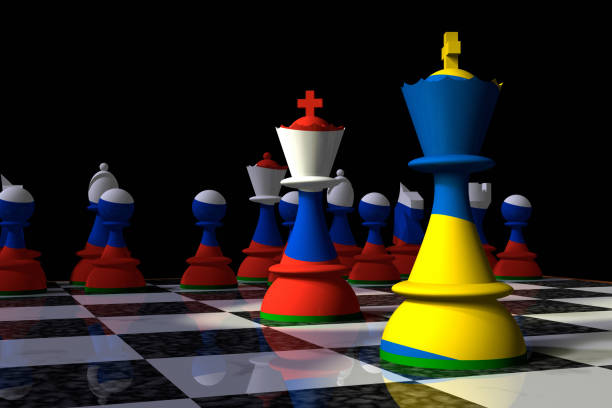

UKRANIAN CRISIS – And repositioning of grains flows

The economic interdependence of the countries of the world is highlighted as soon as the word “crisis” appears, and the effect on the markets is immediate, with counters that panic: on March 7 , the barrel of oil from the North Sea reached 140 dollars, close to its record of 147.50 dollars reached in July 2008, European gas is soaring by 60% to more than 300 euros per megawatt hour, and gold prices exceeded $2,000 per ounce.

Russia 1st world wheat exporter meeting about 20% of demand

After energy and metals, the grain market is not left out. The combined exports of Russia and Ukraine represent a third of the world’s flows of soft wheat and barley, enough to ignite markets already at the highest: wheat May 2022 that same day in opening exceeded 400 € / mt, while maize touched 360 € / mt.

According to France Agrimer, the conflict has direct impacts on global supply and demand for wheat, maize, barley, sunflower oil and oilcake (ongoing season but also spring sowing). Russia and Ukraine account for 79% of world exports of sunflower oil, 30% of wheat and barley, 20% of maize. Ukraine is the world’s 4th largest exporter of maize (18% world market share), 5th largest exporter of wheat (12%), and 3rd largest exporter of barley. A sustained occupation of eastern Ukraine by Russia would deprive it of 30% of its barley and 40% of its sunflower, wheat and maize.

The Black Sea Ports in question

The Russians have controlled access to the Sea of Azov since the annexation of Crimea in 2014. The two major Ukrainian ports bordering it – Mariupol and Berdiansk – are suffocated, while the ports of the Black Sea (Odessa, Yuzhny, Nikolaiev, Chormomorsk, Kherson) are supplied by trains and suffer logistical problems.

In addition, shipping companies see their insurance premiums at their highest to load goods in this area. According to Reuters, rates for a seven-day period have risen between 1% and 2% or even up to 5%, compared to 0.025% before the invasion, which can translate into several hundred thousand dollars for a trip.

According to Philippe Chalmin, president of the magazine Cyclops, 15 million tons of wheat, and as many as corn, would be blocked in the ports of the Black Sea. Before the conflict, Ukraine still had 6 Mt of wheat to export out of the estimated 23 Mt for the 2021/22 marketing year, and 18 Mt of maize out of the 33 Mt to export.

Mediterranean countries strongly impacted

The supply of cereals will be very complicated, especially for certain countries such as Egypt (61% dependent on Russia and 23% on Ukraine);Turkey (63% of imports from Russia and 11% from Ukraine), Lebanon (51% of imports from Ukraine) and Tunisia (41% of imports from Ukraine).

For EU countries, a large share of maize supplies comes from Ukraine (56%), while the availability of wheat is not linked to the Russian market (less than 0.01% of imports).

A more than uncertain future

The market in the Mediterranean basin will find it difficult to do without Russian wheat and Ukrainian maize, even if this opens up opportunities for French exports , especially wheat. The issue of food security already arises in the countries most dependent on imports to feed their populations.

Higher energy and fertilizer prices will be another factor to consider when forecasting future harvests. Indeed, nearly 40% of the price of nitrogen fertilizers is based on the price of gas and an uncontrolled surge in the prices of these fertilizers could greatly weaken the willingness of French farmers to produce additional wheat.

If we add economic sanctions, geostrategic alliances, and weather hazards (severe drought in Latin America), this year 2022 will test a little more our resilience to face of all these global changes.

Sources :

France Agrimer: Statistical elements and highlights on the agricultural and agri-food trade of Ukraine and Russia

Idèle: Ifip-Idele-Itavi Commodity Outlook n°1 – February 24, 2022

Terre-net.fr: What are the impacts of the war in Ukraine on agriculture and markets?